It has been arranged that the earnings obtained by social media content creators from their activities will be exempt from income tax. Accordingly, the newly added Article 20/B to the Income Tax Law No. 193, effective from January 1, 2022, states: “The earnings obtained by social content creators who share text, images, sound, video, and similar content through internet-based social network providers, as well as the earnings obtained by those who develop applications for mobile devices such as smartphones or tablets through electronic application sharing and sales platforms, are exempt from income tax.”

In today’s digital age, traditional professions have undergone significant changes, leading to the emergence of new job roles driven by technological advancements and the need for individuals to exist on social network platforms. The group referred to broadly as social media content creators produces various forms of content through social media and, consequently, earns income in return. To ensure that this income is subject to tax, a legal change has been made.

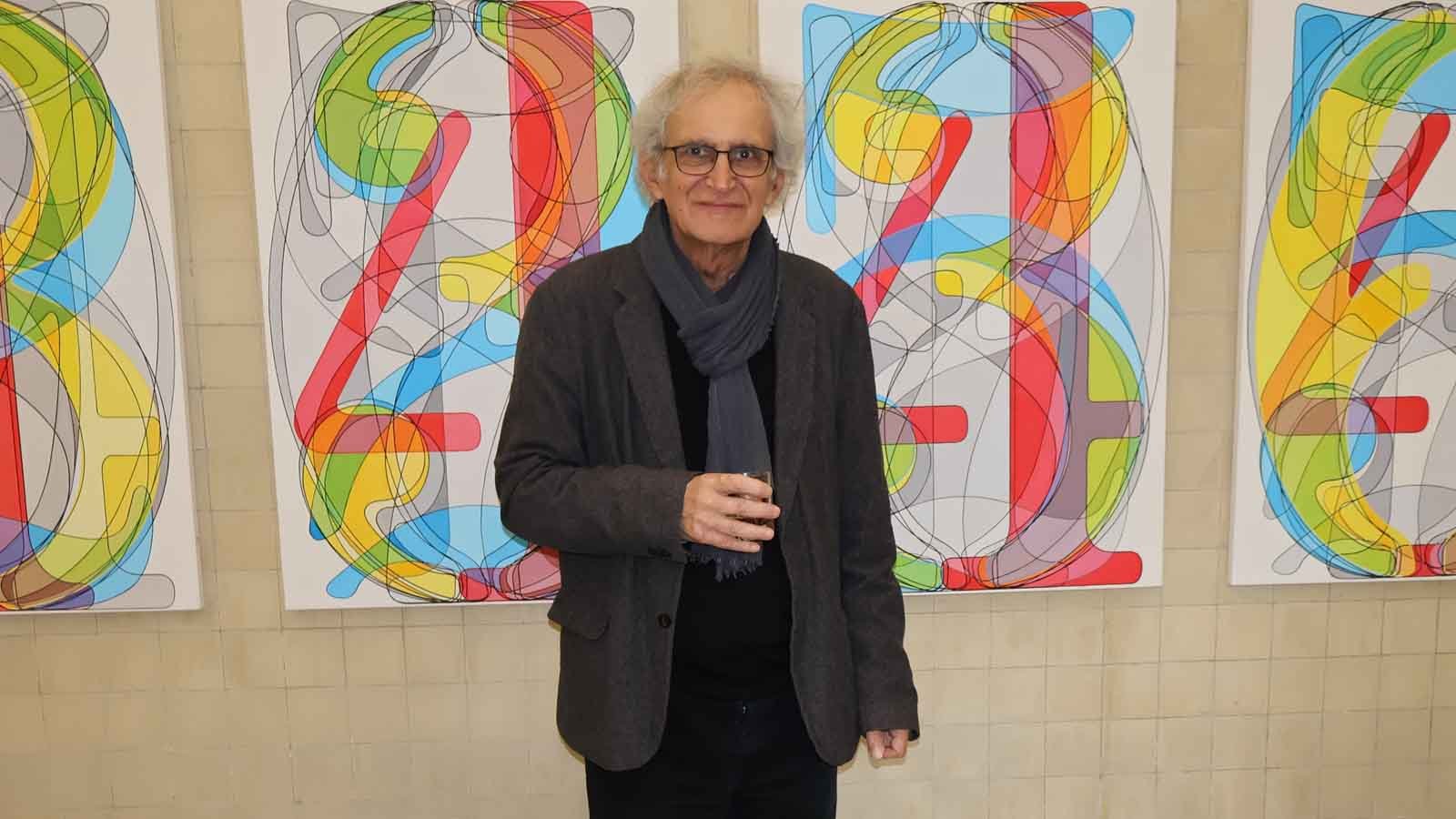

In statements regarding the issue, the founder of Akalp Law Office, Attorney Ahmet Volkan Akalp, noted, “Before the change, the incomes obtained by individual content creators sharing content via social media were considered commercial income, subjecting taxpayers to various obligations due to income tax. However, with this regulation, a simpler and easier method has been preferred to exempt taxpayers producing content on social media from income tax compared to the previous approach.”

The Law Covers Social Media Content Creators and Application Developers

Akalp, who explained the scope of the income tax exemption, stated, “This exemption will benefit individual social content creators who share text, images, sound, and video through the internet and similar electronic environments, as well as individuals who develop applications for mobile devices such as smartphones or tablets. The earnings obtained by these individuals from their activities will be exempt from income tax. The term ‘earnings’ should be understood in a broad sense, as the expansion of social media and advertising has led to an increase in the aspects we consider as earnings within these professions. Therefore, elements such as advertising revenues, sponsorships, sales revenues, and paid subscriptions can also be included within the scope of earnings. Thus, if any content creator sharing content through social network providers earns any income, similarly, the earnings obtained by those developing applications for smartphones/tablets from application sites or sales platforms will be exempt from income tax,” he said.

Akalp also listed the conditions for benefiting from the exemption:

- Obtaining an exemption certificate,

- Opening an account in banks established in Turkey with the exemption certificate and ensuring that all revenues related to these activities are collected exclusively through this account,

- The total earnings under this article must not exceed the amount specified in the fourth income bracket of Article 103 of the Income Tax Law (for 2024, this amount is 3,000,000 TL).