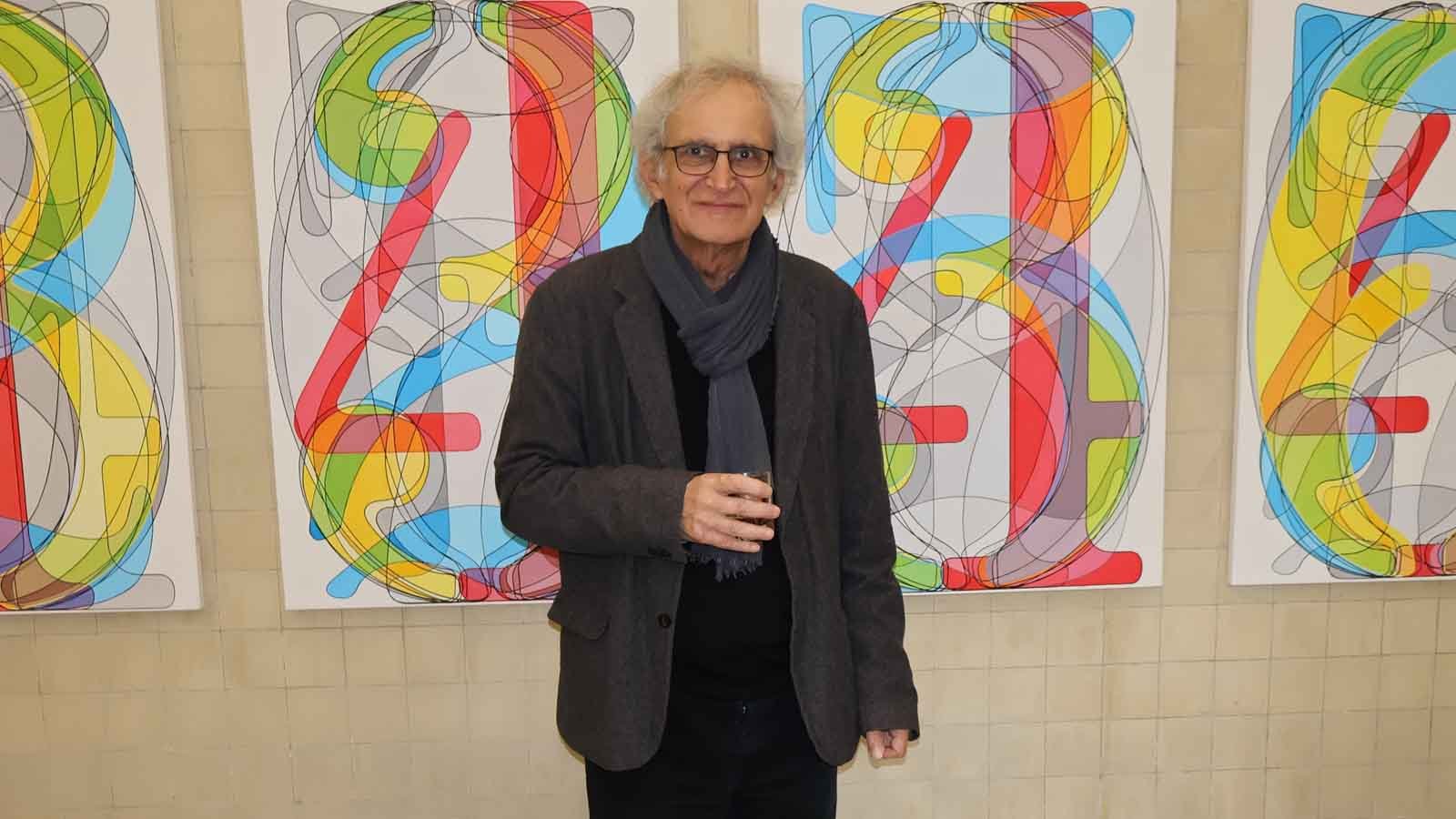

In order to assess Turkey’s economic developments and review financing activities, Trade Minister Prof. Dr. Ömer Bolat visited the Turkish Banks Association. The meeting addressed Turkey’s economy, current developments in the global economy, and financing of economic activities.

Focus on Foreign Exchange Earning Sectors and SME Loans

During the meeting with the Board of Directors of the Turkish Banks Association, particular attention was given to developments in loans provided to foreign exchange-earning sectors, SMEs, and small businesses. The participants emphasized the importance of the banking sector for the smooth functioning of the market and the continuation of economic activities.

Praise for the Banking Sector from Minister Bolat

Following the meeting, Trade Minister Prof. Dr. Ömer Bolat stated that the banking sector contributes significantly to the continuation of economic activities and the healthy functioning of commercial life, especially in developing economies like Turkey. Minister Bolat emphasized, “The banking sector is crucial for ensuring the smooth functioning of the market in dynamic economies like ours.”

Turkish Banking Sector and Economic Goals

Minister Bolat highlighted the strong structure and innovative approach of the Turkish banking sector, emphasizing its contribution to Turkey’s economic goals. He particularly noted the essential role of banks in ensuring the survival of SMEs in commercial life and their expansion into foreign markets.

Assessment by Alpaslan Çakar, Chairman of the Turkish Banks Association Board

Alpaslan Çakar, Chairman of the Turkish Banks Association Board, conveyed that they presented Minister Bolat with information on developments in the banking sector during the meeting and received his evaluations. Çakar stated that despite slow global growth and trade, the Turkish economy has been growing close to its potential speed, with increased predictability and improved expectations.

Direction of Economic Growth in the Coming Period

Çakar emphasized that with the macro balances of the Turkish economy being established in a healthier way, growth focusing on production, investment, export, and employment will continue. He remarked, “The share of manufacturing industry, exports, and SMEs in loans has been increasing in line with the focus of economic policy. The share of export loans in commercial loans has increased by 6 points in the last 2 years.”

The Future of the Banking Sector and its Contribution to Growth

Çakar concluded by stating that the banking sector, with its healthy balance sheet structure, experienced management, skilled workforce, diverse product and service offerings supported by new technology, and an approach considering climate risks, will continue to contribute to growth.