The Turkey Banks Association’s November 2024 report highlighted the rapid spread of remote customer acquisition processes. The report emphasized the growing share of remote customer acquisition in total customer acquisition and the shift of users towards digital platforms.

704,000 People Became Bank Customers Through Remote Applications

Since the introduction of the regulation in May 2021, which allows banks to conduct identity verification and acquire customers via remote application methods, individuals no longer need to visit a bank branch to become a customer. They can complete the process by contacting a customer representative through the mobile application of the bank of their choice.

During this period, where users’ inclination towards digital channels has increased, a total of 704,155 people became bank customers through remote applications in November. A 10% increase in the number of remote customers was observed compared to October.

Supporting this trend, HangiKredi continued to make a difference in the sector with its user-friendly solutions. One in four people became a bank customer via HangiKredi.

0% Interest Opportunities: The Most Important Part of the Process

Due to rising credit interest rates, it has been observed that users have been turning to credit cards and 0% interest cash opportunities for small amounts. In particular, 0% interest cash opportunities of up to 75,000 TL, offered by banks to new customers, have increased the number of applications through digital channels.

Digital Financial Technologies and HangiKredi’s Innovative Approach

HangiKredi’s success is directly linked to the contribution of financial technologies in the digitization of loans. By simplifying the loan comparison and application processes online, HangiKredi offers over 100 offers from more than 25 banks under one roof. This comprehensive solution helps HangiKredi provide financial advantages to both individual and corporate users.

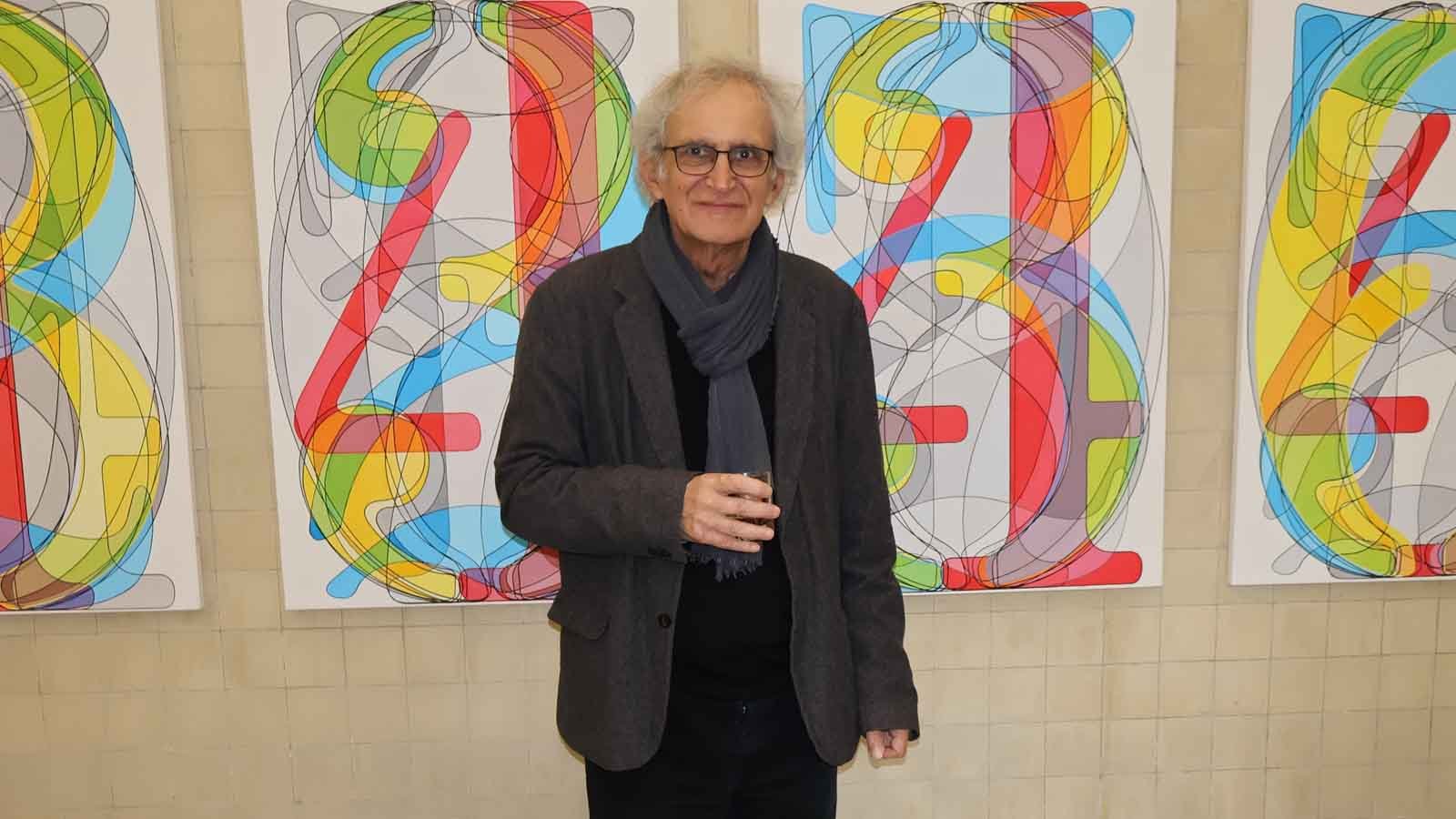

Onur Oğuz, CEO of HangiKredi, stated the following about the success achieved: “As a reflection of the value-focused services we offer to our users, we have reached a high market share of 25% in remote customer acquisition, continuing to maintain our leading position in the sector. This success is a result of the trust our users place in HangiKredi for their financial solutions. Especially during the Black Friday shopping period, the increase in the use of loans and credit cards further highlights consumers’ need for these services. As HangiKredi, we will continue to respond to these needs in the fastest and most effective way.”

Credit Usage Increased During Black Friday Shopping!

During the Black Friday period, the use of shopping loans and credit cards increased significantly. According to the Banking Regulation and Supervision Agency (BDDK) 2024 data, the loan volume increased by approximately 6 Trillion 620 Billion TL in the first 10 months of the year. A significant portion of this growth came from online loans, with digital platforms playing a key role in supporting the increase in loan usage. During this period, consumers’ interest in financial planning and loan comparison platforms also grew. In particular, campaigns and discounts on e-commerce platforms led consumers to turn to loan products to finance their spending. Across Turkey, loan volumes reached their peak during this period compared to previous months.

During the Black Friday period, users increasingly turned to financial comparison platforms to manage their budgets effectively and evaluate advantageous options. HangiKredi facilitated a more efficient shopping experience by quickly offering consumers advantageous loan and credit card options. By simplifying users’ financial decisions, HangiKredi set a new standard in the world of digital banking. As a leader in remote customer acquisition, HangiKredi continues to shape the future of the financial technology sector with its innovative solutions.